VAT Relief at Health and Care: Everything You Need to Know

If you have a chronic condition or disability, you might be entitled to VAT relief on certain products – but what exactly is VAT relief and how does it save you money on the products you need? Here at Health and Care, we've put together a comprehensive guide on VAT Relief: Everything that You Need to Know to help cut through the confusion and help you save money.

What's Covered in This Guide?

- What Is VAT Relief?

- Which Products Can Be Bought with VAT Relief?

- How Do I Claim VAT Relief on Health and Care?

- Any Other Questions?

What Is VAT Relief?

What Is VAT?

VAT (value-added tax) is a sales tax that is added to non-essential goods and services in the UK (currently set at 20%). Some products (for example food, children's clothing, or books) do not have VAT and these products are said to be "zero-rated". For others, VAT is applied but VAT can be waived or claimed back for certain individuals, which is where "VAT Relief" comes in.

Who Can Claim VAT Relief?

There are two main considerations when it comes to VAT relief:

- Is the product designed for someone with a chronic disability or condition?

- Does the recipient of the product have a chronic disability or condition?

For example, if you are diabetic and you wish to buy glucose testing strips, this would be available with VAT relief as you are using a product that is designed for a specific condition that is a lifelong affliction. On the other hand, if you have broken your ankle and are using a walker boot, this is not eligible for VAT relief as your ankle will heal over time.

Can I Claim VAT Relief on Behalf of Someone Else?

If you are buying on behalf of another individual – for example if you buy a parent or grandparent a product to aid with a condition like Alzheimer's disease – you can claim VAT relief as though you are buying the product for yourself.

Who Cannot Claim VAT Relief?

As well as people who do not meet the criteria outlined above, unfortunately you are also not eligible for VAT relief if you are buying a product to be used in a hospital or care home. Similarly, businesses cannot claim VAT relief when purchasing eligible products.

How Is VAT Relief Calculated?

VAT in the UK is (at the time of writing) set as a 20% levy on the selling price. For example, if the price of a given product is £100.00 without VAT, it would have a total of £120.00 including VAT. Therefore if you bought a product for £120.00 with VAT, you would save £20.00 if buying with VAT relief.

Does VAT Always Apply to Sales?

VAT is not applied to all products; for example, books do not have VAT added to them and therefore they cannot be bought with VAT relief as there would be no VAT applicable to your order. Similarly, orders being delivered to Jersey or Guernsey will not include VAT.

Which Products Can Be Bought with VAT Relief?

Which Products Are Eligible for VAT Relief?

For a product to be eligible for VAT relief, it must have been designed specifically to combat a long-term disease or condition. For example, a pressure-relieving wheelchair cushion would be deemed eligible for VAT relief as it is helping to protect the user against a specific issue (the development of pressure sores when using a wheelchair). If, however, you were looking to buy a regular cushion to use on your wheelchair, while it may help prevent pressure sores, it has not been specifically designed for that purpose and would not be eligible for VAT relief.

Examples of Products that Can Be Bought with VAT Relief at Health and Care

As a retailer that sells a number of helpful products for people with disabilities or chronic conditions, we have a huge range of products that can be bought with VAT exemption. Some of our most popular areas include:

- Amplified Telephones

- Walking Sticks and Canes

- Bath Lifts

- Pressure Relief Cushions

- Epileptic Seizure Monitors

- And many more...

How Do I Identify Products that Are Available with VAT Relief?

To help you tell as easily as possible whether or not a product is VAT relievable, we have a number of indicators to show that a product is available with VAT relief.

VAT-Relief Labels

One of the easiest ways to identify products that are available with VAT relief is seeing whether they have the label below on the product image. Please note that while the majority of our products that are suitable for VAT relief feature this sticker, there are some that do not.

An example of our VAT-relief label

VAT-Relief Tabs

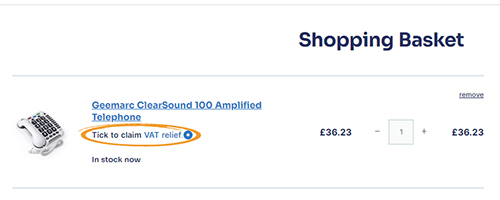

All of our VAT relievable products should feature a "VAT Relief" tab that explains that the product is available with VAT relief. See below for an example on our one of our amplified telephone listings.

An example of our VAT-relief tab

What If a Product Is Not Highlighted as VAT Relievable?

Sometimes, it is not immediately clear to us whether a product should or should not be available with VAT relief, and this means that there are products for which VAT relief could apply that we do not have flagged as being suitable. If you find a product that you believe should be available with VAT relief, please contact our customer care team at helpdesk@healthandcare.co.uk, who will be happy to look into the suitability of the product for you.

How Do I Claim VAT Relief on Health and Care?

Claiming VAT Relief as You Place Your Order

The easiest way to claim VAT relief on a product is to claim the relief as you place your order, meaning that the VAT is automatically removed from your order. This can be done in the following way:

Step One: Add the product or products that you wish to purchase to your basket

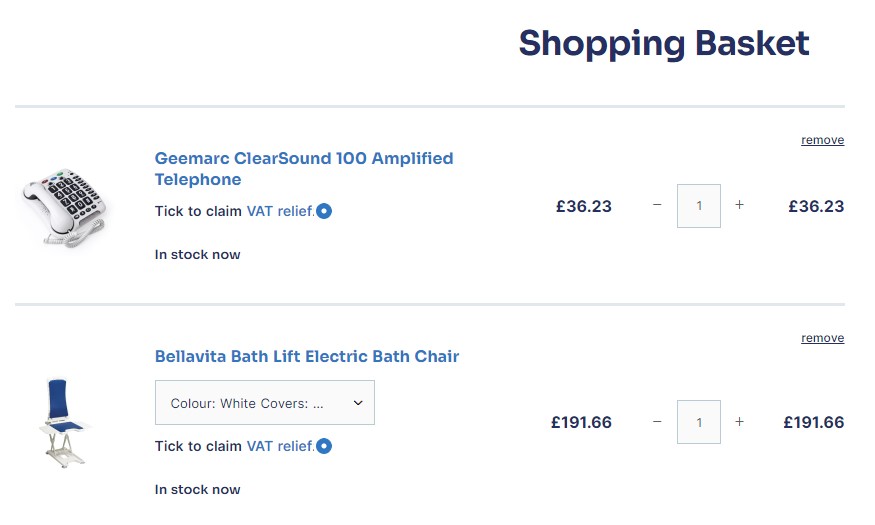

Step Two: On the shopping basket, select the option of VAT relief (as shown below)

Please note that if there are multiple products that are available with VAT relief, each one will need to be ticked individually (as shown below)

Step Three: On the checkout, you will be asked to fill in an additional form declaring your eligibility for VAT relief. Fill this in with your details and complete your order!

Claiming VAT Relief After an Order Has Been Placed

If you've already placed an order and weren't aware that you could claim VAT relief, don't panic! We also allow customers to claim back any VAT that they have paid that they didn't need to pay.

To claim back VAT on an order that you've already placed, please fill in the form below:

Once this has been received and checked by a member of our team, we will refund your VAT via your chosen payment method.

Any Other Questions?

Hopefully, we've covered most bases about VAT relief, but if you have any other questions regarding VAT, please contact our customer care team at helpdesk@healthandcare.co.uk and a member of our team will be in touch with you shortly.